TapFin Risk & Underwriting in Sustainability Tool (TRUST)

A fleet intelligence layer for confident lending

What we solve:

Lenders today are underwriting fast-growing, asset-heavy sectors with limited on-ground visibility, delayed risk signals and fragmented data, especially in the less informed sectors like Electric vehicle financing.

TRUST solves this by combining asset health and performance analytics, borrower profile data, and AI-driven risk analytics giving lenders a single platform to underwrite smarter, monitor continuously, and recover faster across the entire asset lifecycle, through ReSell – our marketplace to sell old EV assets at a higher, more informed pricing.

Our core solutions:

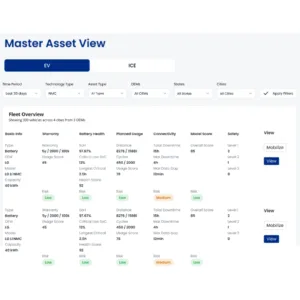

End-to-End Asset Lifecycle Management

Intelligent Financing & Risk Management

Seamless Technology Integration

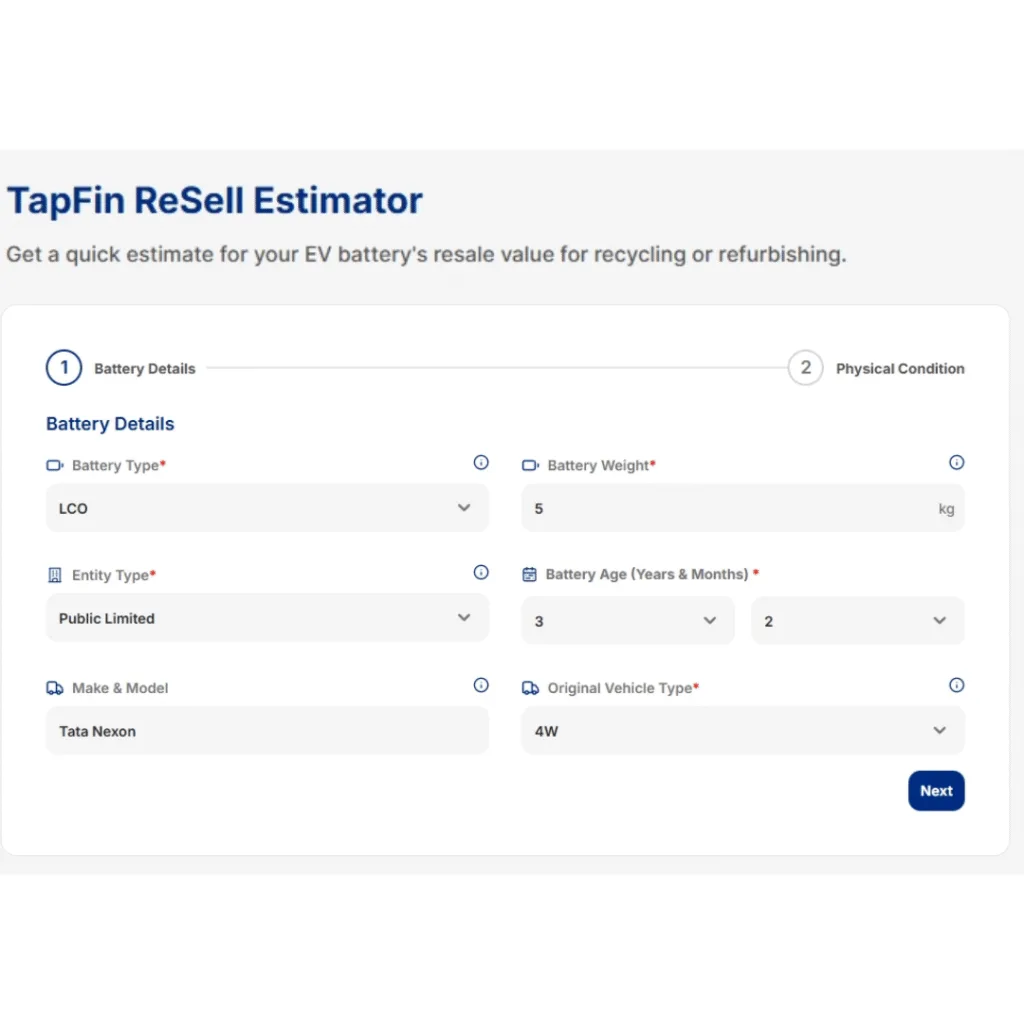

ReSell - Recovery & Secondary Market Enablement

The TapFin Advantage

Embedded financing. Built for Lenders.

TapFin brings together financing, technology, and deep asset intelligence into one unified platform. From data-backed AI-enabled underwriting and real-time risk monitoring to predictive alerts and smarter recoveries, TRUST helps lenders operate with precision, confidence, and control across the full asset lifecycle.

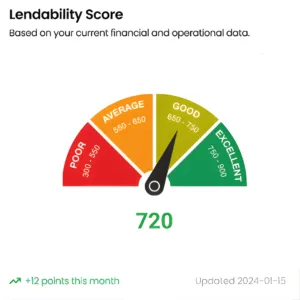

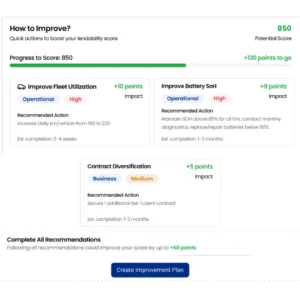

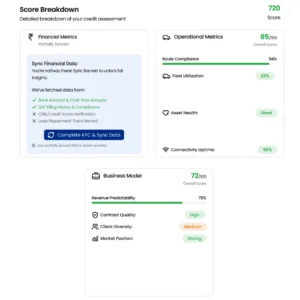

Lendability Score to assess and track fleet eligibility

Early risk prediction for revenue drops, misuse, and NPAs

Live utilisation, revenue, and health insights for smarter underwriting

Faster approvals with higher confidence

Stronger recoveries through intelligent ReSell

Enhanced vehicle security with remote lock/unlock

Contact us

With TRUST, sustainability is no longer guesswork — it’s precision-engineered.

Get in touch

Powering a Greener future with you!

Visit Us

Email Support

Let's Talk